1. The Hands On phase

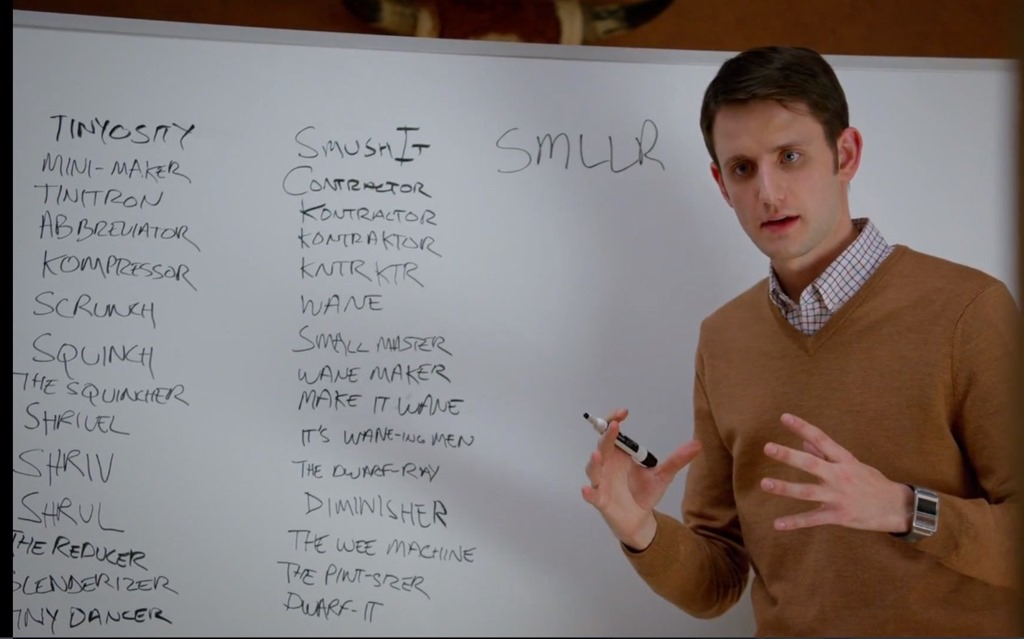

Like every great episode of Silicon Valley, it all starts with a whiteboard. Customer (demand) and worker (supply) names are written on the board, with relevant skills and availability scribbled down. Everyone gets on the phones and calls each side, trying to make connections. Every connection is a new possibility, a new thread in the web you’re trying to spin. You’re losing money on every one, but if you’re doing it right they start to become sticky.

This means customers are not just delighted that you introduced them to someone that can solve a problem for them, but that it has the seeds of an ongoing relationship. They enjoy working with the person, they need that problem solved ongoing and (for your benefit at least) they see the value you add as the third wheel.

At worst they appreciate the comfort of having you on the phone to handhold them through the process, at best you are a critical part of the value chain that is hard to replicate without scale. Except you don’t yet have scale so this might cost you big time upfront – software, insurance, data, templates, logistics, call centre etc. Don’t resent the cost, because it’s also your barrier to competition. Watch that burn while you find market fit.

2. The Acquisition Marketing phase

Once the relationships are sticky and your churn is under control, you need to scale quickly to bring your unit cost down and start to pay off that upfront investment (or raise on a growth pitch to kick this can down the road). It’s time to look at the chicken and egg problem of liquidity. What services are not getting traction, and how might each translate into an efficient performance marketing campaign?

You probably have no brand equity, so your performance marketing needs to be very targeted and ideally not competing with established sector players. It’s also tricky to scale, because your segments could be very small and fast moving. 95% of marketplaces are demand constrained, so start by focusing on 1 side only.

Start testing campaign segmentation by customer type first until you get your CPA down to at least breakeven, before trying to solve for secondary variables like geography or availability. You’ll also need to start building a view on Lifetime Value (LTV) by each segment, so eventually you can think about bidding based on Return On Ad Spend (ROAS) or similar metrics. But every customer is different, and so this quickly also becomes a scale challenge that will require marketing data investments.

Don’t purely optimise on cost however, as the goal of this phase is to build number of connections not the number of users. Don’t underestimate power users who create a lot of connections even if they don’t spend a lot, you need to talk to and learn to love these people without becoming too dependant.

This phase is why 50% of startup investor’s money goes to Facebook and Google, you need to learn to love their tools and optimise (aka the sexier “growth hacking”) like crazy. But this needs to be just a phase – if you never graduate then you are at the mercy of the next algorithm change and/or well funded competitor. Don’t become the next GroupOn who spent like crazy here but never graduated.

3. The Product Growth Phase

Also called the Network Effect phase. This is the holy grail, where your product flywheel starts to spin and growth happens organically. There are 3 major things required here.

Finally and foremost – you need to understand what part of those calls in phase 1 relied on the human touch, and what was to overcome objective friction. Pour the gold of your customer service team over the trust issues, and scale the rest in-product with great UX that makes your funnel so intuitive as to be invisible.

Focus relentlessly on removing any friction in making a new connection; this could be through removing double commits, applying data and recommendation engines, teaching your users how their behaviour affects their success, systemically weeding out quality and fraud issues and many more concepts.

Finally you should clearly commit only to verticals where you can be number one. Your next key competitor will play in a narrower not a wider vertical than you, so you need to lead market share not just overall but more importantly in the key customer segments you care about. The network effect is a big moat, but it isn’t the winner takes all endgame it was first thought to be.