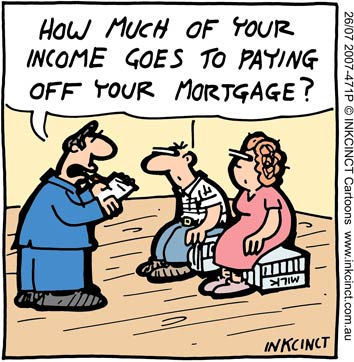

It is not hard to find doomsday predictions for the Real Estate market. Sites such as Who Crashed the Economy are a collation of tales of pending economic (and particularly housing sector) destruction. There is a trend that indicates mortgage stress and housing price falls are limited to the outer suburbs of Sydney, primarily the west and south-west. Even when you analyse mortgage stress on a nationwide basis these suburbs keep appearing.

So I guess the question is whether this effect will be seen in the more blue label, inner-city suburbs. Most experts seem to think that the next 9 months or so are a good time to buy; if you have some savings tucked away and can ride out high interest rates in the short term. The next official inflation reading comes out on July 23, so a change in rates after this time is entirely possible. Whether the increases end there, or another ones comes in November, is anyones guess. I will be watching these news stories pretty closely, as it seems most of Australia is.

I was prepared to bid at an auction on the weekend, but it sold for $100k (15%) more than the quoted price range, and $50k less than what turned out to be the vendor’s target selling price! Clearly there is still a lot of dodgy underquoting practices from certain agents and turbulent pricing changes are still shaking themselves out in this market. I just have to hang in there and hope (as evil as it is) that a foreclosure can deliver me a reasonably priced dream home.