Iconically, one of the reasons I left Google was that it made too much money. Prioritisation seems pointless when the business is printing cash. I wanted to feel the weight of prioritisation, of profit and loss, and test whether I actually knew how to do strategy when it actually can change the outcome.

So I went to a startup and, despite not even being breakeven, everything was a strategic priority. More specifically, there was a rotating list of priorities depending on the week, weather and if it was school holidays or not. Unsurprisingly, there were 100 great ideas sitting on the shelf. More concerningly, there were 20 almost finished projects sitting on the shelf. As an example, the data team had built a rigously back tested recommendation engine, but there was no product requirements or strategy for actually solving a customer problem with it.

Where do you even start to build a great startup strategy?

Step 1: It’s ok to start broad

The goal is to explain why (not how) only a few key actions are critical to delivering a single goal. A north star metric or outcome is the definition of that single goal. Usually for a Saas business that’s some type of ongoing user engagement, assuming you have tied engagement to revenue.

For example on YouTube that north star metric was video watch time, given watch time has a proven causative relationship with both happier customers and more exposure to advertising revenue. At Mable that was hours of delivered care, again with an assumption that longer and more relationships was a better customer outcome, and revenue was a % of timesheets delivered. Find that north star for your company, and ideally make it as tied to the purpose and vision as possible.

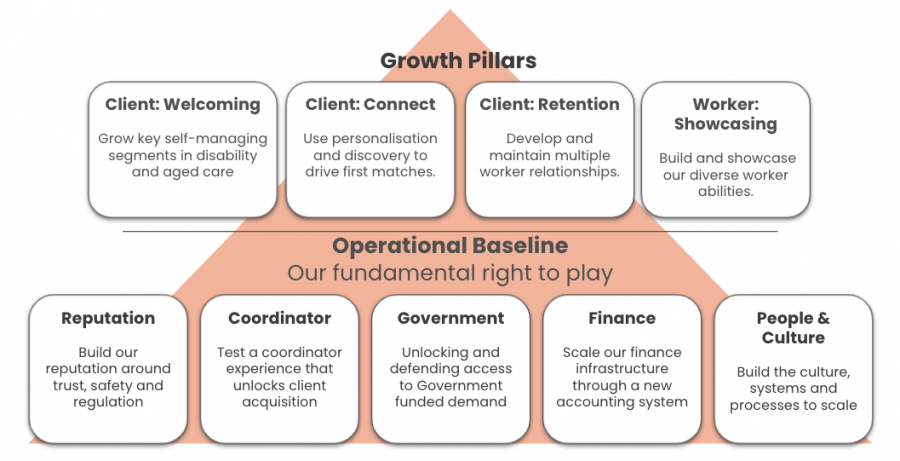

Next you need some strategic pillars to support this north star. Usually you will start with meaningless and broad pillars like “Our Customers” or “Our team”. These are generally too broad to be useful, every company has these same assets so they are not strategic advantages.

So now they need to be made more specific. We’re a growth startup, so “Our Customers” then becomes “Streamline customer onboarding” because we need growth above all else. This is the right decision if onboarding is both a key strategy for the current market, AND also a key competitive difference you have.

Step 2: Tie it to the business model

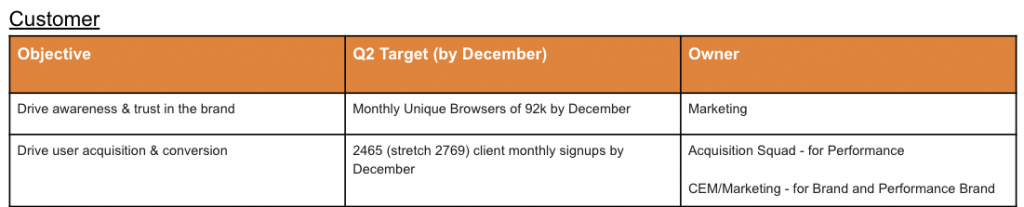

One way of narrowing down the strategic pillar is to put a specific metric on it. For example, maybe instead of just broadly talking customer onboarding, we could specifically look for monthly user signups.

By building a rough business model in Excel, you can then ladder targets up to a desired north star goal. For example if your north star is video watch time, then you can model how many new customer signups you need to hit that target and cascade these targets down to your strategic pillars. This is a good process in itself, because you soon understand what are the 5 or so key drivers of your business model – what’s actually correlated with hitting your goal.

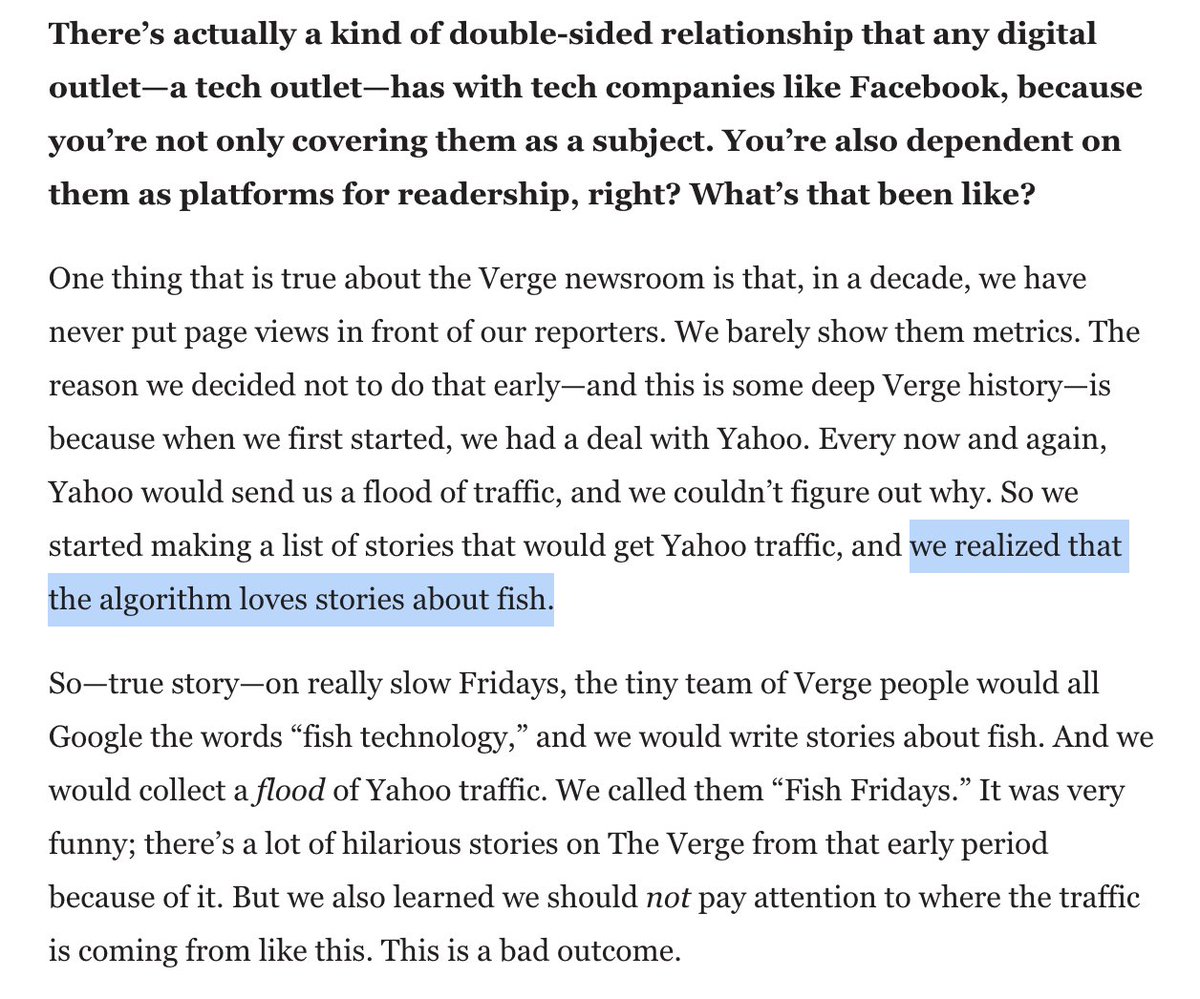

The danger at this step is that you get so focused on your target that you forget why you were even chasing it. A classic example is The Verge:

As you start questioning your goal metric, it’s worth doing some slicing and dicing. Is every customer signup worth the same? Are some stickier than others? Where are the best referrals coming from?

Step 3: The why

Gievn what you now know about the broad strategic areas, and the inner workings of your business model, what is the strategic lever you hold in your hands?

For example you might realise that some key customer signups are churning 50% less than others. Perhaps they are more empowered, have more time to invest or something else – discover that “why” behind their objective success. Another way of asking this is to send out a Product Market Fit (PMF) survey and to see who would actually be devastated if your product disappeared?

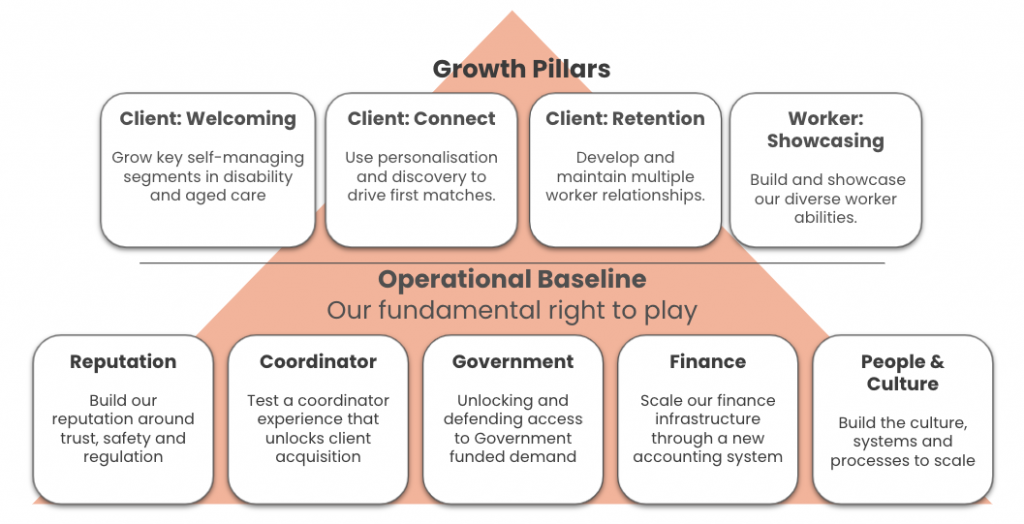

The goal should be an Egyptian style pyramid that captures the “why” behind each of the strategic levers that are unique for you:

The struggle at this point is getting the pillars down to 3-5. If you’re a startup then growth is the goal (otherwise you’d just be a small business), so capture the growth levers on the top row of the pyramid.

There will no doubt be a ton of other fundamental problems that need to be solved as you scale. These might be HR systems, culture, risk management etc. that are critical to scale but not strategic growth levers. Capture these in the baseline of the pyramid.

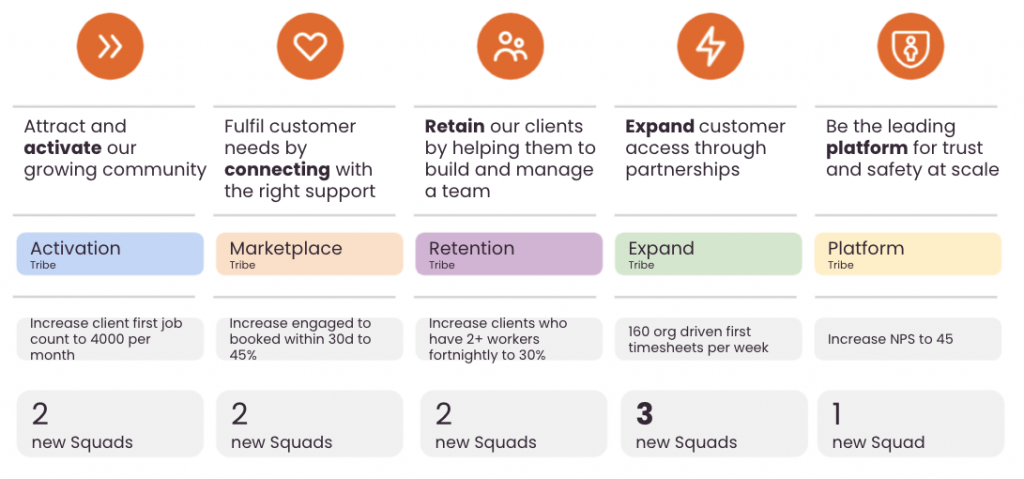

Step 4: Deploy resources

The nice thing about this visualisation is you can communicate a really critical nuance – which strategic areas need all the resource they can get, versus which areas just need to be solved. For example risk might be something you absolutely need to manage at scale, but your customer value proposition vs the market isn’t safety. Therefore it’s a baseline problem that needs to be solved with a small team on a schedule.

As your team grows, you can illustrate just how much resource has gone into each strategic pillar. The executive level conversation then uplevels to a triangular discussion that tests the three sides of this strategy:

- Why – Do we have the right why? Is our strategy working?

- Metric – Are we moving in line with the business model?

- Investment – Are we investing the right amount to move the dial?

Conclusion: Layer up your strategy pyramid

Congratulations, now you have an overall strategy pyramid. Each pillar of that pyramid has three dimensions that can be tested on a regular basis to ensure you’re delivering on your strategy. Good luck!